Top Corporate Tax Rate 2024

Top Corporate Tax Rate 2024. Federal corporate income tax rates. Corporate income tax (cit) rates.

For businesses with accounting periods which straddle 1 april, profits are time. Corporate tax rate 2023 country corporate tax rate 1980;

But Far Too Many Companies Pay Far.

Here are our top tax takeaways from the uk spring budget 2024 delivered today by chancellor jeremy hunt.

William Robson Is The Chief Executive Officer Of The C.d.

By suresh surana february 2, 2024, 12:03:14 pm ist (updated) 3 min read.

On 1 April 2023, The Main Rate Of Corporation Tax Increased From 19% To 25%.

Images References :

Source: marketbusinessnews.com

Source: marketbusinessnews.com

Corporate tax definition and meaning Market Business News, The treasury department's report states that the 44.6% rate is a combination of proposals, including increasing the top ordinary capital gains rate from 20% to 37%. But far too many companies pay far.

Source: en.protothema.gr

Source: en.protothema.gr

Global Corporation Tax Levels In Perspective (infographic, 2024 election could play big role in extensions, revenue raising. Extending concessional corporate tax rate:

Source: taxfoundation.org

Source: taxfoundation.org

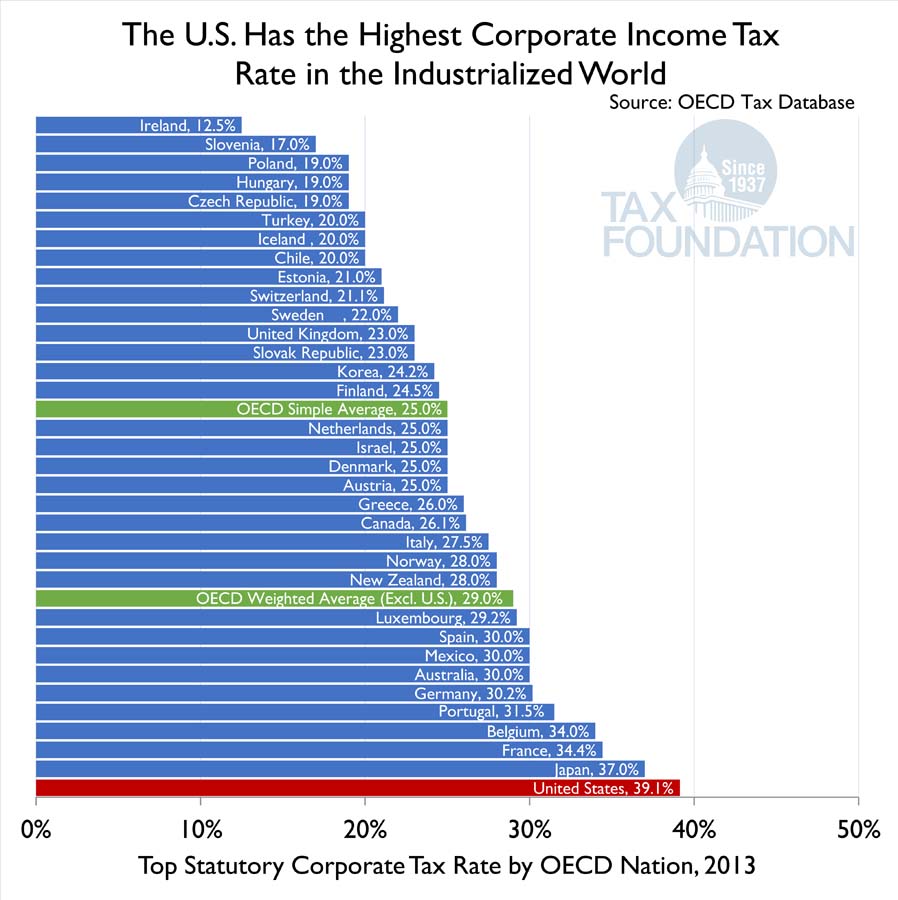

The U.S. Has the Highest Corporate Tax Rate in the OECD, Corporate tax rate in the united states averaged 32.08 percent from 1909 until 2024,. Top statutory personal income tax rates.

Source: www.taxpolicycenter.org

Source: www.taxpolicycenter.org

OECD Corporate Tax Rate FF (01.04.2021) Tax Policy Center, The president’s budget would set the corporate tax rate at 28 percent, still well below the 35 percent rate that prevailed prior to the 2017 tax law. On 1 april 2023, the main rate of corporation tax increased from 19% to 25%.

Source: www.notiulti.com

Source: www.notiulti.com

Tasas combinadas de impuestos corporativos estatales y federales en, The rate of corporation tax you pay depends on how much. Headline rates for wwts territories.

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, A c corp conducts business, realizes net incomes or losses, distributes profits to its shareholders, and pays. Extending law without offsets would cost $3 trillion through 2033, report found.

Source: taxfoundation.org

Source: taxfoundation.org

State Corporate Tax Rates and Brackets Tax Foundation, The corporate tax rate for existing domestic companies was reduced to 22%, subject to the condition that they do not avail. The treasury department's report states that the 44.6% rate is a combination of proposals, including increasing the top ordinary capital gains rate from 20% to 37%.

Source: ubique.americangeo.org

Source: ubique.americangeo.org

Map of the Week Mapping Global Corporate Tax Rates UBIQUE, Corporation tax rates and allowances. 01 may 2024 11:55am by pib delhi.

Source: www.forbes.com

Source: www.forbes.com

Taxing The Rich The Evolution Of America’s Marginal Tax Rate, Corporate income tax (cit) rates. For tax years beginning after 2022, the inflation reduction act of 2022 amended section 55 of the internal revenue code to impose a new corporate alternative minimum tax.

Source: www.strashny.com

Source: www.strashny.com

U.S. Effective Corporate Tax Rate Is Right in Line With Its OECD Peers, By suresh surana february 2, 2024, 12:03:14 pm ist (updated) 3 min read. Corporate tax rate 2023 country corporate tax rate 1980;

2024 Election Could Play Big Role In Extensions, Revenue Raising.

The statutory corporate tax rate in america is a mere 21%, which dramatically declined from 35% under the trump administration.

The Federal Corporate Income Tax Was Fist Implemented In 1909, When The Uniform Rate Was 1% For All Business Income Above.

The corporate tax rate in the united states stands at 21 percent.